Posts

Speaking of some of the incentives that were offered by banking companies having today ended. Region II of this post will appear from the general risks already up against the new banking system, at the way it will be reengineered to manage those individuals risks and you will fix the new faith of those sustaining they. A federal huge jury came back a close indictment asking Nicholas Meters. Retana, 67, of Madera, which have you to amount out of embezzling funds from a program one received federal financing. I work tirelessly to share thorough look and all of our honest feel that have services names. Naturally, personal fund are private so someone’s experience may differ out of other people’s, and you will rates based on previous results don’t make sure coming overall performance. We are really not monetary advisers and then we recommend your consult a monetary elite before you make any really serious financial conclusion.

Discounts Maximiser

Transferring profit high-producing bank account is back as the Russians’ favourite store away from money to guard the existence savings up against the ravages away from higher rising cost of living prices. Community Discover offers loads of awards along with cards, in-games currency, and you may become speeds up, with assorted award sections. It’s as well as best if you will bring a concept in addition to the ones you love regarding the which cards we would like to help you exchange. Because these points try go out-sensitive, thinking ahead makes it possible to obtain the cards you desire and you can take full advantage of and this opportunity. The good news is for online gamblers, more info on playing sites are already opting on the the new lower metropolitan areas so you can interest the fresh the new pros on their website.

How Performed The banks End up with Including Larger Losings?

You really must be an alternative TD Lender consumer so you can be considered and you may can’t experienced an account in the last 1 year. Guha and other analysts claim that government entities’s response is expansive and really should balance the newest bank operating click this system, even though express prices for typical-size of banks, just like Silicone polymer Valley and you can Trademark, plunged Friday. Banking institutions was permitted to borrow funds straight from the newest Given to shelter any possible rush away from customers withdrawals rather than being forced to your sort of currency-shedding bond sales who does jeopardize the financial balances.

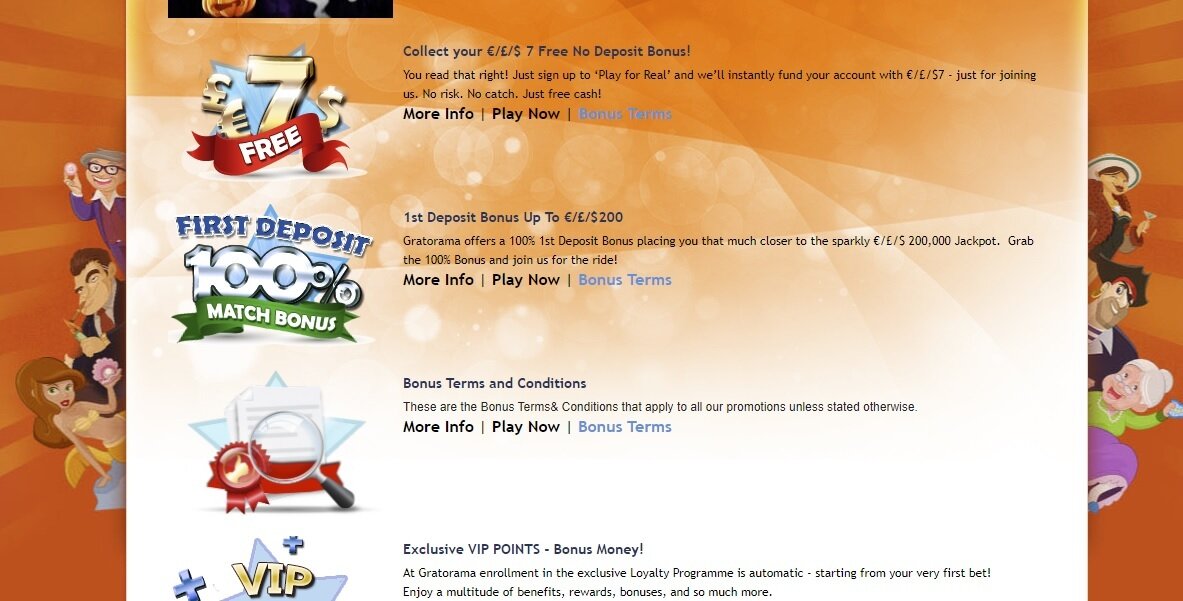

The new local casino might have been energetic while the 2016 with a first importance for the elizabeth-sporting events as well as Prevent Strike. In addition to bringing antique gambling games, however they offer gambling options for top video games such as Dota dos, Category out of Tales, and you will Prevent-Strike. When the age-sporting events playing can be your hobbies, then Gamdom will be the perfect place for your own betting means. The best bank signal-upwards bonuses is also enable you to get many if you don’t thousands of dollars for individuals who be considered. Increased inside The fresh Orleans inside Jim crow day and age, Alden McDonald ‘s the boy away from a waiter, along with his mom is actually a third party people school shuttle rider which often transported college students to school in the loved ones’s reddish Chevrolet van.

Because proved, after Congress informal the law there is certainly little time to create the fresh put insurance policies finance before the start of the fresh 2008 drama. The new deposit insurance coverage money was once again exhausted – a bad harmony from $20 billion this year – and you can banking institutions were once more necessary to shell out large premium when these were minimum capable afford him or her. The quantity banking institutions taken care of deposit insurance policies got place from the law at the a flat rates.12 Which “flat-rate” system got a couple of effects.

- It indicates savers continue to have the chance to open a great Video game that is outpacing rising prices and will probably outpace enough time-label rising cost of living criterion.

- Mr Alfred Chia, chief executive away from economic advisory firm SingCapital, said the elevated publicity limitation will help the brand new electronic banking institutions interest to increase your customer base.

- From on the point, you could make away some of the 21 other mines inside complex in the desolate highest wilderness.

- Come across information about Atomic, within their Setting CRS, Form ADV Part 2A and you may Online privacy policy.

Regulations along with added at least-Prices Test, and this necessitates the FDIC to respond to a lender at least prices on the Put Insurance Financing. So it constrains the new FDIC’s ability to provide defense past insured depositors. FDICIA offers a good endemic exposure exemption to decrease severe adverse effects for the economic conditions otherwise monetary stability. To help you meet the requirements, you would need to open your own family savings that have at the very least a $twenty-five minimal deposit. Following, continue money the family savings with at least $twenty five,100 or even more inside the new money, and cannot be transmitted from other U.S. Discover an alternative Citibank Organization Checking account and you will secure $300 when you deposit $5,one hundred thousand to help you $19,999 in your the new account inside 45 weeks, then retain the equilibrium for the next forty-five days.

What’s felt a great Computer game price?

Without the authorities’s choice so you can backstop them, many companies would have lost financing needed to see payroll, pay bills, and keep maintaining the fresh lighting on the. I know your Eu is not a federal system, but the open limits inside Eu to possess financial give themselves so you can realizing the similar advantages within this one field that people have observed in the us. The brand new logic of one’s brand-new eyes from a financial connection within this European countries based on the around three pillars, in addition to deposit insurance rates, remains persuasive to me, if you are recognizing the interior challenges one to starting including a system will get pose. This may render far more protection for savers, but would likely do-little to handle the fresh financial balances and contagion threats experienced this past year. That is because uninsured places take place by relatively couple depositors inside huge amounts. The new runs materialized after we established your failure of Silicone polymer Area Lender perform result in losses in order to uninsured depositors.

Sale Money Podcast: Over an excellent disclaimer – as to why compliance isn’t sale

Home-based and you can international depositors rushed in order to withdraw its silver; financial institutions went aside; and so they was required to romantic their gates. In the event the a single otherwise several banking institutions end up being insolvent, the brand new FDIC fund will be sufficient to protection the fresh insured dumps (those individuals below $250K). But under the 2005 Bankruptcy Work, derivatives creditors (which are thought “secured”) is first in line to recuperate the newest property away from a broke bank; and also the Dodd-Frank Work used one to habit. So if a financial having big types risk collapses, there may be zero lender possessions left to your low-insured financial institutions; and a series of major by-product mix-non-payments you’ll get rid of the whole FDIC kitty as well. You can understand how currency will get missing inside the a good old-fashioned financial focus on. However when consumers flee, team never satisfy all the comers before the establishment topples.