Articles

Excludable durability payments may not be linked with worker times has worked, productivity otherwise results. Excludability is founded on recognition out of period of or love away from provider. Which rule became problematic whenever the brand new kinds of worker benefits (think parking, transportation, fitness, technical although some) advanced. Businesses was tend to not knowing whether or not to are otherwise ban the newest benefit brands on the price.

Salaried personnel who make less than $step one,128 weekly otherwise $58,656 annually are nonexempt, just in case it wear’t work with any of the aforementioned spots. The fresh FLSA lays aside strict significance of excused and you may nonexempt pros. To own going not in the label out of obligation, so it hourly personnel has gained $951.28 recently.

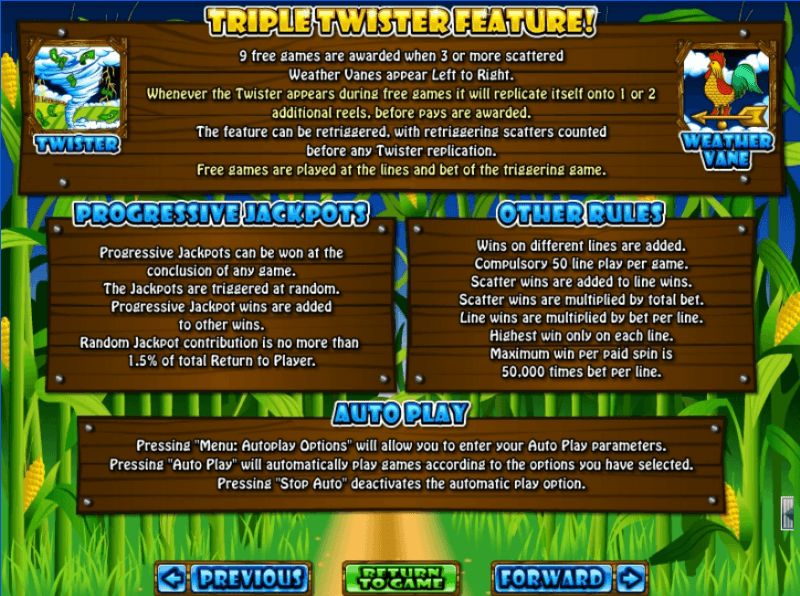

With its signs reminiscent of might slot machine game, players are able to find you to definitely 5 times Spend also offers a straightforward position which have a simple-to-gamble construction. 5 times Pay the most preferred large volatility slot online game readily available. The 5 Times Pay slots game features wilds providing 5 times and twenty-five times the brand new payouts within the effective combos, and you may a potential jackpot from 15,100 gold coins within the step three reels and you can step 1 shell out-range. Salary comments have to tend to be detailed information including disgusting earnings made, full days spent some time working, piece price devices and you may costs (if the appropriate), deductions, internet wages, and inclusive times on the shell out several months. At the same time, they should feature the new employee’s term (with only the very last four digits of the societal defense matter otherwise a choice identifier) plus the employer’s name and you may target.

Error #10: Defectively using the changing workweek means.

Which enjoy an optimal gambling establishment incentive to own huge gamblers like, for this reason while the expert position followers manage. And yet it offers the sort of ease and simple game play you to definitely slot newbies feel the possibility to strongly recommend. You’ll find a lot fewer profitable compositions to help you guess at the than in numerous almost every other IGT titles nevertheless the grand profits are way too tempting in order to forget about. Tend to, when slots remove the present day gameplay have they impacts the fresh winnings prospective of a position, but thanks to the multiplying wild icon, there isn’t any including concern about Five times Shell out.

TL;DR: How to work with incentive payroll (

In depth paperwork is important for openness and you can responsibility. Inability to include certified food or other people periods can result in more settlement to have inspired personnel. This type of advanced, thought wages, include an additional time out of buy for each and every work day where a good buffet otherwise people months was not offered while the required by-law. For low-excused personnel operating changes more than four occasions, a meal split should be provided before the end of your fifth time. In a few issues, companies might be able to get buffet months waivers or be considering an in-obligations meal several months, but stringent criteria need to be came across. Non-exempt workers are in addition to eligible to repaid 10-minute people holidays for each four-hours has worked, or a primary fraction thereof.

Average per week income Dataset EARN01 | Put out 17 July 2025 Average weekly money during the market level title prices, The united kingdom, monthly, seasonally adjusted. Annual mediocre regular earnings gains to you can check here the personal industry are 5.5% inside the February in order to Get 2025, much like the previous three-few days period (Contour 4). Yearly mediocre typical earnings development on the private industry is actually 4.9%. Normal gains for the personal field try last below cuatro.9% regarding the November 2021 in order to January 2022 months, if it try cuatro.5%.

Directory of IGT Harbors

Inside higher firms with in-household work unions, added bonus conclusion are typically negotiated anywhere between administration and you will group while in the yearly conversations stored from the springtime, to February. These types of dealings see whether incentives was comparable to, such, three or four weeks’ paycheck. Non-exempt staff should be purchased all day long it invest doing work. Companies cannot query or allow it to be these types of staff to be effective “off-the-clock.” Provides an insurance plan you to explicitly prohibits of-the-time clock functions and possess regulation in position to avoid they.

When a member of staff receives in excess of $one million inside the supplemental earnings, the brand new withholding to the excessive is 37 per cent, with respect to the Internal revenue service. With Homebase, you might pay incentives rather than drowning inside the computations or talking about baffled team—let-alone agreeable your own party, tune go out, and you may focus on your typical payroll. If the an employee produces below $1 million in the extra earnings inside the 2025, the newest government apartment withholding price is 22%.

Right here, you will simply appreciate step three upright paylines complimented because of the online game’s 3 reels. However, there’s something amazing in the 5 times Shell out slots real cash, and it is the new RTP. As stated over, when choosing a keen employee’s normal speed away from pay money for the fresh aim away from overtime, you need to tend to be nondiscretionary bonuses.

- The brand new numbers, generally equivalent to 3 to 6 months of paycheck, decided due to labor-administration negotiations.

- For example compensation is generally creditable to the overtime shell out owed underneath the FLSA.

- All the information of the paytable is directly on display screen to help you the best area of the reels, along with details of how the bonus element works.

- All the had been simple, legit, and you may expected little more than doing a free account.

A warehouse management earning $sixty,100000 having $10,100 inside overtime you will shave a couple of thousand bucks off their government goverment tax bill. A resorts bartender making $45,100 along with $5,one hundred thousand within the info could get back all of the government fees withheld off their information. For individuals who’re also financial to your income tax-totally free overtime to improve their income, you’re of chance.

But not, should your added bonus are made more than a few workweeks, the bonus must be within the typical price of shell out in every overtime months covered by the benefit period. If necessary, you can even briefly your investment extra in the computing the conventional every hour rates if you don’t know the extra amount. Next, apportion it straight back along side workweeks of your own period during which the newest employee gained the main benefit. A plus is actually a fees built in inclusion to your personnel’s regular earnings.

It is important to have businesses to understand the financial obligation and options of employee settlement to help you restriction prospective responsibility visibility and you can getting a competitive pro on the market. Including payment may be creditable on the overtime spend due within the FLSA. The amount of time and a half price try an FLSA-mandated minimum amount companies need to pay taxable team for each overtime hour worked.

Multiplier cards arrive immediately after all of the fifteen hand, and the average multiplier dimensions are 4.05x. This is going to make an average winnings just after a good multiplier regarding the 20.33% much more, which is a a great choice because the you are only paying 20% far more to help you wager the brand new sixth money. Due to this, it is best to play Very Minutes Pay game instead of regular online game with the same shell out table. D. Incentives as much as $one million are usually taxed in the a condo speed out of 22 % (increased payment to possess numbers more than $one million). For government taxation, when an employee obtains $1 million otherwise reduced in the supplemental earnings while in the 2018 and people wages are identified on their own out of typical wages, the fresh flat withholding is 22 %.